Just weeks before it is due to release its Q2 earnings on Aug 16, Walmart shocked markets after the close when it slashed its profit outlook for Q2 and FY2023.

The full statement indicates that the warnings we laid out about the pain from inventory liquidation and the “bullwhip effect” are finally here:

Walmart provided a business update today and revised its outlook for profit for the second-quarter and full-year, primarily due to pricing actions aimed to improve inventory levels at Walmart and Sam’s Club in the U.S. and mix of sales.

Comp sales for Walmart U.S., excluding fuel, are expected to be about 6% for the second quarter. This is higher than previously expected with a heavier mix of food and consumables, which is negatively affecting gross margin rate. Food inflation is double digits and higher than at the end of Q1.

This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel.

During the quarter, the company made progress reducing inventory, managing prices to reflect certain supply chain costs and inflation, and reducing storage costs associated with a backlog of shipping containers. Customers are choosing Walmart to save money during this inflationary period, and this is reflected in the company’s continued market share gains in grocery.

Walmart also stole the jam out of the ‘strong consumer’ donut by blaming the lack of consumer power and the imminent widespread (and deflationary) inventory liquidation on the soaring costs of food and fuel…

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars. We’re now anticipating more pressure on general merchandise in the back half; however, we’re encouraged by the start we’re seeing on school supplies in Walmart U.S.” said Doug McMillon, Walmart Inc. president and chief executive officer.

As a result, Walmart said operating income will likely decline by between 13% to 14% over its fiscal second quarter, which ends in July, and between 11% and 14% for the full year.

Worse, adjusted earnings are forecast to slide between 8% and 9% for the second quarter, and 11% to 13% for the year, a sharp decline from its May forecast of just a 1% pullback.

Finally, operating margins are likely to come in at 4.2% for the second quarter, before narrowing to between 3.8% and 3.9% for the full year, Walmart added.

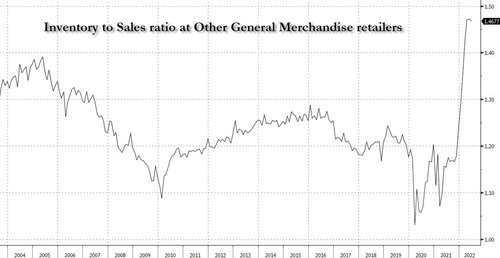

Walmart, which saw a 33% increase in overall inventories last quarter (and which we discussed extensively in “Deflationary Tsunami On Deck: A “Tidal Wave” Of Discounts And Crashing Prices“), said in early May that it would keep prices “as low as we can” in order to shift inventories over the coming months.

Alas, It appears the inventory liquidation is not going well…

Here’s how it works – as we detailed previously – Food inflation is double digits and higher than at the end of Q1. This is affecting customers’ ability to spend on general merchandise categories and requiring more markdowns to move through the inventory, particularly apparel. So the sequence is as follows:

-

inflation is too high

-

consumer is tapped out and has to limit their spend

-

Walmart and other retailers over-inventoried

-

They now have to liquidate inventories into a much weaker environment

And while this is great news for consumers who are about to see sharply lower prices as there is a lot of inventory to liquidate…

… it’s very bad news for WMT shareholders who are seeing their stock down around 9% after hours…

… And dragging the broad market lower:

Is this the beginning of the deflationary tsunami, and the unofficial start of the non-recession… because the White House would never lie to us, right?

“Walmart did not just cut guidance” https://t.co/EpM1tY6gRY

— zerohedge (@zerohedge) July 25, 2022

And while we wait to see how long before Walmart’s inventory liquidation turns into an employee liquidations, the only question is whether this will be seen as “bad news is good news” and will force the Fed to end its hiking cycle faster, because while clearly a major negative signal for the US consumer, it also suggests that a deflationary tidal wave is about to sweep general merchandise retailers who have no choice but to liquidate into a recession, and spread from there sending most prices sharply lower in the coming weeks.