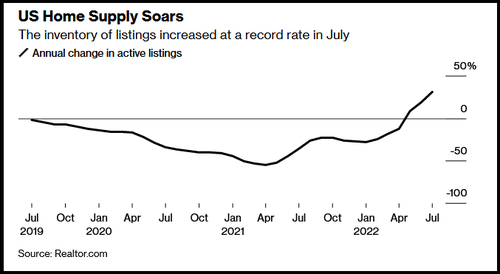

The number of houses sitting on the market grew at a blistering pace last month, with the number of active listings jumping 31% vs. the same period last year – a record-high increase for a third straight month, Bloomberg reports, citing a Tuesday report from Realtor.com.

The sharp slowdown in activity suggests that the Federal Reserve’s efforts to curb inflation through rate hikes have had a dramatic effect on the pandemic housing frenzy, as higher borrowing costs have sidelined many would-be buyers. Sellers, consequently, have responded by trimming prices to compete.

“With inventories increasing, buyers will have more negotiating power,” according to Realtor.com chief economist, Danielle Hale. “The two years of a market heavily tipped in favor of sellers appears to be in the rearview mirror.”

That said, inventories are still lower than they were pre-pandemic, while the median list price remained 17% higher in July than a year earlier.

Inventory has yet to return to pre-pandemic levels. And even as options increase, competition for homes remains strong, keeping prices elevated. The nationwide median list price in July was $449,000, up 17% from a year earlier and close to the all-time high reached in June. The affordability crunch and remote-work policies have been pushing some people to relocate to less-expensive areas.

New listings last month contracted for the first time since March, down 2.8% from a year earlier, suggesting some owners are reconsidering their plans to list with the market shift. -Bloomberg

Bloomberg also reports that homebuilders have found themselves stuck with too many houses has demand has cooled.

“There’s a bit of pressure on us,” said Kevin Brown, a realtor who deals in new homes. “Builders have got to hit goals and make their profit, and they don’t like inventory just sitting on the ground.”

This year’s surge in mortgage rates tossed buyers to the sidelines. The waitlists for new houses are gone. And new-home sellers such as Kevin Brown, who works just south of Houston, are on the front lines of a massive shift.

…

An abrupt halt to the pandemic housing boom has left builders that started construction months ago scrambling to adapt. The US supply of new homes relative to sales in June was the highest since the midst of the last crash in 2010. And by early July, buyer traffic to homebuilder websites and sales offices had plunged to the lowest level for the month since 2012, according to a survey of builder sentiment from the National Association of Home Builders.

In June, there were 824,000 single-family homes under construction in the US – more than at any time since October 2006, according to the NAHB. Unsold inventory has ballooned, partially as a result of supply-chain disruptions and labor constraints.

“It has become a very competitive market for builders where they are trying to offload any standing inventory,” said Ali Wolf, chief economist for Zonda, which tracks new-home production. “We may see a period where supply may actually exceed demand for a while in some of the markets that were the most feverish over the past two years.”

Shiller chimes in

According to economist Robert Shiller, who predicted the 2008 housing bubble, the US housing market is headed for trouble.

“Home prices haven’t fallen since the 2007–09 recession. Right now things look almost as bad,” he said. “Existing home sales are down. Permits are down. A lot of signs that we’ll see something. It may not be catastrophic, but it’s time to consider that.”

He added that a drop on home prices is more likely than not.

“The Chicago Mercantile Exchange has a futures market for home prices…That’s in backwardation now; [home] prices are expected to fall by something a little over 10% by 2024 or 2025. That’s a good estimate,” he told Yahoo Finance. “The risks are heightened right now for buying a house.”