By Sagarika Jaisinghani and Tasos Vossos, Bloomberg Markets Live commentators and reporters

Resilient earnings and bets of peaking inflation have helped stocks and corporate bonds rally alike over the past couple of months, but with recession fears still lurking, the two asset classes could soon start taking different paths.

European stocks have gained about 9% since a low in early July, while corporate bonds are up 4.4% since bottoming in mid-June.

With Federal Reserve officials indicating they’ll keep monetary policy tight until they’re sure that inflation won’t flare up again, even at the cost of some economic pain, debt from safer firms may benefit from a potential flight-to-safety. But for stocks, it’s a risk to earnings that many investors may be unwilling to bear.

“What we’ve seen at this juncture is a bear market rally and we don’t want to chase it,” says Wei Li, global chief investment strategist at BlackRock, speaking of the rebound in equities. “I don’t think we’re out of the woods with one month of inflation cooling. Bets of a dovish Fed pivot are premature and earnings don’t reflect the real risk of a US recession next year.”

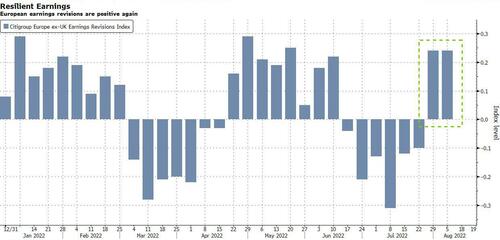

The second-quarter earnings season did much to restore faith in the health of Europe Inc. as companies largely proved demand was robust enough for them to pass on higher costs to consumers. But economists forecast a slowdown in business activity from here on, while Citigroup strategist Beata Manthey says she expects regional earnings to fall 2% this year and 5% in 2023.

And while investors in Bank of America’s latest global fund manager survey have turned less pessimistic about global growth, sentiment is still bearish. European stock funds saw outflows of $2.2 billion in the week to Aug. 17 — a 27th straight week of redemptions, according to a BofA note that cited EPFR Global data.

Strategists now expect the Stoxx 600 to end the year at 447 points — about 2% above current levels, according to the average of 15 estimates in Bloomberg’s monthly survey. BofA’s European strategists remain negative on the region’s equities as well as cyclicals versus defensives.

In the bond world, the layers that make up a company’s borrowing costs look set to play into investors’ hands. Corporate yields comprise the rate paid on similar government debt and a premium to compensate for threats like a borrower going bust.

When the economy falters, these building blocks tend to move in opposite directions. While a recession will raise concerns about firms’ ability to repay their debt and widen the spread over safe bonds, the flight-to-quality in such a scenario will cushion the blow.

To be sure, the summer rebound has made entry points in corporate bonds somewhat less appealing. George Bory, head of fixed income strategy at Allspring Global Investments, has turned more cautious on bond valuations, but remains bullish on them overall. “The world was becoming more bond friendly place and that should continue in the second half of the year,” he says.