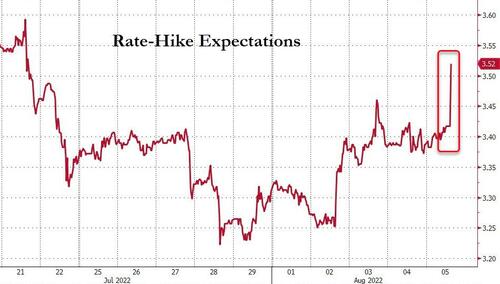

The massive beat in the payrolls print has removed any hopes of a Fed Pivot and sent rate-hike expectations soaring…

With the odds of a 75bps hike in September now topping 70% once again…

All of which stole the jam out of the market’s bullish donut with stocks plunging…

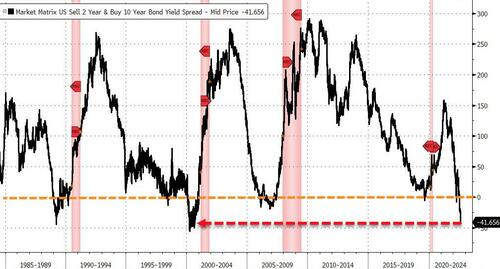

Bond yields spiking with the short-end getting battered (2Y +16bps)…

The yield curve is flattening aggressively – 2s10s now at its most inverted since Aug 2000…

And gold tumbling…

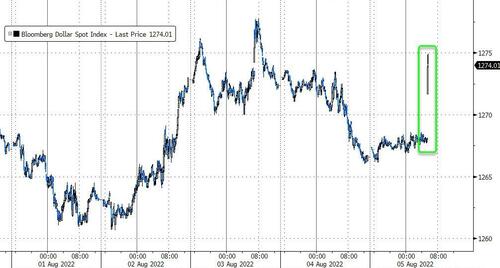

But the dollar is bid…

Is Mr. Powell re-writing his J-Hole speech already? And all those hawkish Fed Speakers this week are suddenly being listened to…