GOP lawmakers call for transparency on government’s student loan portfolio

Alex Nester • May 6, 2021 5:20 pm

Republican lawmakers claim that the Biden administration is burying a report that shows how shoddy accounting at the Department of Education could cost taxpayers billions.

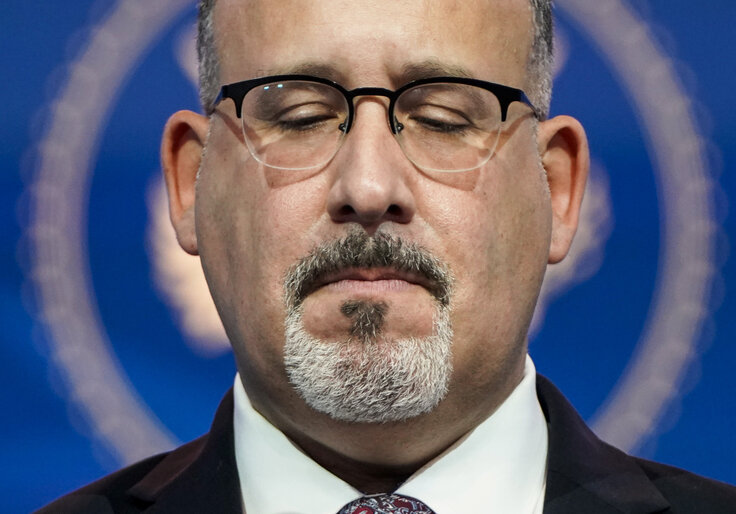

In a letter to the Government Accountability Office (GAO), Representatives Virginia Foxx (R., N.C.) and Greg Murphy (R., N.C.) say Secretary of Education Miguel Cardona is hiding information from a Trump-era report that found that student loan repayments have continuously fallen short of the Education Department’s projections. Taxpayers may end up footing the bill for that discrepancy, which could amount to roughly one third of the federal government’s $1.6 trillion student loan portfolio.

The demand for financial transparency comes as the Biden administration moves to spend big on higher education. President Joe Biden last week proposed his American Families Plan, a $1.8 trillion spending package that promises Americans at least two years of taxpayer-funded higher education. And the president asked Congress to relieve $10,000 in student loans per borrower in January.

Foxx and Murphy are asking the GAO for information regarding the government’s negligent accounting practices.

“We understand the Department of Education is hiding information from the public that could provide a more accurate depiction of the budgetary impact of the federal student loan program,” the letter says. “The stakes are simply too great for Congress to look the other way and allow these accounting games to continue.”

In 2018, then-education secretary Betsy DeVos tapped former JPMorgan executive Jeff Courtney to investigate whether the department was overestimating borrowers’ willingness to repay their student loans. The resulting report, which the Wall Street Journal reviewed in April, found a major gap between projected and actual student loan repayments.

Courtney concluded that lawmakers have spent decades trying to make the federal student loan portfolio look profitable in order to justify expansions of the aid program. The government operates under the assumption that it will recover nearly all defaulted student loans. Actually, it recovers just over half.

The true cost to taxpayers of the federal loan program is likely much higher than the government has projected for decades, the report found.

The Biden Education Department ended Courtney’s project in February, claiming that DeVos commissioned as part of a scheme to end the federal student loan program, the Journal reported. The Biden administration will not consider Courtney’s findings in further evaluations of the federal government’s student loan program.

Foxx told the Washington Free Beacon that while the problem is decades old, the Biden administration is the first to ignore it altogether.

“Taxpayers shouldn’t be asked to foot a 12-figure bill for federal bureaucrats’ bad accounting. President Biden’s administration is not taking this report seriously simply because they do not want to acknowledge the federal student loan system is in desperate need of reform–what a disgrace,” Foxx said. “While these negligent calculations have persisted through decades of presidencies, President Biden is the first to deliberately keep this information out of Americans’ hands. We deserve transparency.”

Murphy said the administration’s refusal to consider the report demonstrates Biden’s “carelessness” with taxpayer dollars.

“The Biden administration’s latest actions just show more of the same carelessness with taxpayer money we’ve come to expect since he took office,” Murphy told the Free Beacon. “At the rate we are spending right now, we can’t afford to waste hundreds of billions of dollars.”

The Education Department does not analyze borrowers’ credit or consider their chances of defaulting before issuing loans. If private sector companies operated under such projections, they “wouldn’t be in business anymore” and would “probably be behind bars,” DeVos said in December.

Cardona on Wednesday told a House appropriations subcommittee that the government should ramp up student loan forgiveness.

“I think we need to do better with public service loan forgiveness. About 98 percent [of claims] have been rejected,” Cardona said. “To me, this really needs a very critical look to make sure that the intention that you had in Congress is followed through on and that we are doing everything to put our students at the center of conversation.”