Oil prices have tumbled 25% since early June, driven by low trading liquidity and a mounting wall of worries: recession, China’s zero-COVID policy and real estate sector collapse, the US SPR release, and Russian production recovering well above expectations.

However, Goldman’s Damien Courvalin believes that the case for higher oil prices remains strong, even assuming all these negative shocks play out, with the market remaining in a larger deficit than we expected in recent months.

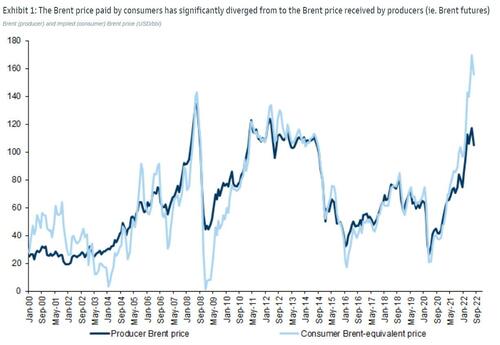

The bullish thesis does though require addressing the huge divergence between Brent prices, which averaged $110/bbl in June-July, and the $160/bbl Brent-equivalent global retail fuel price.

Conceptually, two prices matter for modeling the oil market:

(1) the retail price of fuels paid by consumers as it drives demand elasticity and

(2) the crude price received by producers as it drives supply elasticity.

Up until 2021, retail prices followed a stable relationship to Brent prices but this is no longer the case due to significant distortions to each of the steps required to transform crude oil coming out of the ground into fuels consumed by producers.

Goldman sees three main takeaways from this:

-

The good: retail prices – while not tradable – came in close to our forecasts despite all the current macro uncertainties.

-

The bad: the disconnect between retail and Brent financial prices was much wider than expected, keeping Brent futures well below our forecast.

-

The ugly: our retail price forecast – which proved broadly accurate – did not result in enough demand destruction to end the current, unsustainable deficit.

The much wider than expected gap between Brent physical prices (i.e. Dated Brent, not ICE Brent futures) and global retail fuel prices in Brent-equivalent terms (c.$45/bbl on average in June-July vs. our c.$25/bbl assumption) can be linked to the Russian energy and EU gas crises.

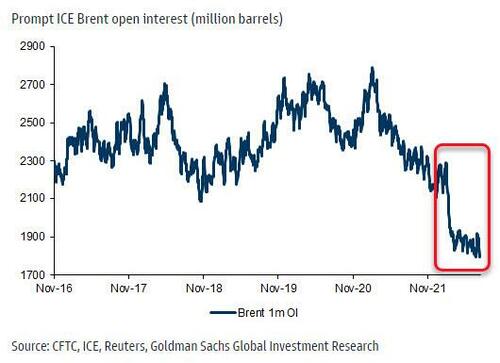

Goldman states that growing lack of financial participation in the commodity futures market helps explain this record wide premium as well as the recent new collapse in Brent prices as well as the current extreme level of crude backwardation.

Market liquidity plumbing new depths…

Courvalin and his team continue to expect that the oil market will remain in unsustainable deficits at current prices.

Balancing the oil market therefore still requires oil demand destruction on top of the ongoing economic slowdown, where we are more cautious than consensus.

This requires a sharp rebound in retail fuel prices – the binding constraint to balancing the oil market – back to $150/bbl Brent equivalent prices, equivalent to US retail gasoline and diesel prices reaching $4.35 and $5.45/gal by 4Q22.

As Goldman concludes, the unprecedented discount of Brent prices, even wider than we expected, can be explained by the worsening Russian energy crisis, as it boosts the costs of transforming crude out of the ground (Brent) into retail pump prices around the world through surging EU gas prices, freight rates, USD and global refining utilization.

While they assume that the exceptional wedge between retail fuel and Brent futures prices will remain wider than previously expected, Goldman still expects that Brent prices will need to rally well above market forwards, with their 3Q-4Q22 forecasts now $110-125/bbl vs. $140-130/bbl previously (with their $125/bbl 2023 forecast unchanged).

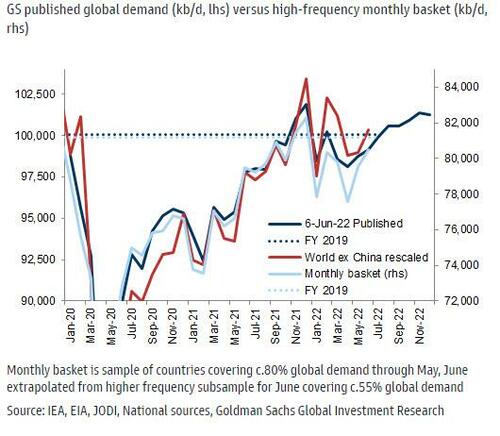

Concerns about their bullish view are warranted though – as recession risks are rising – but as Courvalin notes, reported oil demand has held up surprisingly well

Data for our monthly reported demand sample (covering c.81% of global demand for May and 55% for June) shows demand tracking above our expectations following downward revisions in April.

The demand recovery has been led by jet fuel (+1mb/d YoY for the sub-sample), with the expected weakness in gasoline demand (-0.5 mb/d, given higher price elasticity) offset by strength in industrial products potentially being pulled into the power stack.

The prevalence of retail government interventions such as price freezes/controls (such as those in China and India, versus tax holidays in the OECD) continues to shield oil demand more than expected.