It appears to be yet another brilliant example of Cathie Wood’s investing acumen and a staple of the time-honored investment adage: buy high, sell low.

Wood dumped 1.133 million shares of Coinbase yesterday from her flagship ARKK Innovation Fund, according to data at CathiesArk.com, which tracks the trades and holdings of all of ARK Invest’s funds.

Across all funds, she sold more than 1.4 million share, according to Coindesk. As appears to be part for the course at ARK, Wood is offloading the share just about three months after buying more than half a million shares.

ARK’ Next Generation Internet ETF, or ARKW, sold 174,611, shares, or 0.6768% of the fund’s total investments, the site said. ARKF, meanwhile, sold 110,218 shares.

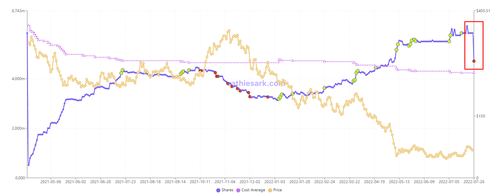

As the chart shows, it appears to be one of the quickest dumps of the stock at any point in recent history for ARK.

Recall, just hours ago it was revealed that Coinbase was facing an SEC probe into whether it improperly let Americans trade digital assets that should have been registered as securities. It is the latest in a series of escalating rhetoric between the largest crypto exchange in the U.S. and various regulators.

Coinbase’s Counsel wrote earlier this week that “Coinbase does not list securities. End of story.” (emphasis ours)

We cooperated with the SEC’s investigation into the wrongdoing charged by the DOJ today.

But instead of having a dialogue with us about the seven assets on our platform, the SEC jumped directly to litigation. The SEC’s charges put a spotlight on an important problem: the US doesn’t have a clear or workable regulatory framework for digital asset securities.

And instead of crafting tailored rules in an inclusive and transparent way, the SEC is relying on these types of one-off enforcement actions to try to bring all digital assets into its jurisdiction, even those assets that are not securities.

Just this morning (and with no prior knowledge of the timing of the charges discussed), Coinbase filed a petition for rule making with the SEC calling for actual rule making so the crypto securities market has a chance to develop. We worry that today’s charges suggest the SEC has little interest in this most fundamental role of regulators.

But in the absence of a concrete digital asset securities regulatory framework from the SEC, we remain confident that Coinbase’s rigorous review process keeps securities off Coinbase’s platform. We remain eager to share our perspective with the SEC, especially through a formal rule-making process desperately needed.

As Bloomberg noted, Gensler has long argued that many cryptocurrencies fall under the regulator’s jurisdiction and that firms offering them should register with his agency.