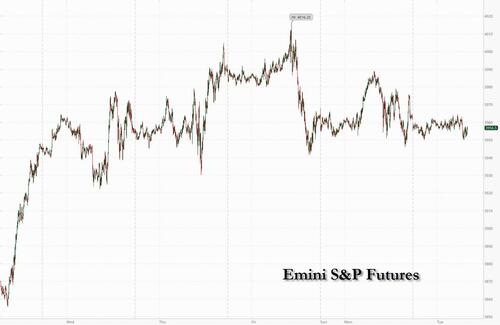

US stock futures dropped as investors braced for Wednesday’s Federal Reserve meeting, while Walmart’s surprise profit warning fueled concerns about the strength of US consumer spending. A barrage of earnings including notable misses by the likes of GM and a 3M guidance cut, did not help the mood. Contracts on the S&P 500 and the Nasdaq 100 were each down 0.4% by 7:45am in New York. European stocks rose driven by energy stocks amid a fresh surge in gas prices following Russia warnings of an imminent halving in NS1 shipments even as European Union countries reached a political agreement to cut their gas use. The dollar jumped and 10Y yields tumbled below 2.75% as a recession looks inevitable, no matter how Biden defines it.

In premarket trading, Alibaba Group jumped 5.1% after the Chinese e-commerce giant said it will seek a primary listing in Hong Kong, boosting other US-listed Chinese stocks with it. Cryptocurrency-exposed stocks were lower as Bitcoin sank to a one-week low, denting hopes for a sustained rebound. Coinbase fell 4% in premarket trading after a Bloomberg News report that the cryptocurrency company is facing a US probe into whether it improperly let Americans trade digital assets that should have been registered as securities. Shares of US big-box retailers and e-commerce peers fell in US premarket trading on Tuesday, after Walmart again cut its quarterly and full-year profit guidance just weeks ahead of its earnings report, raising new questions about the damage from surging inflation to consumers’ spending ability. The shares slid as much as 9.8% in US premarket trading. In premarket trading, Target shares drop as much as 4.9%, Costco Wholesale -2.8%; watch Best Buy shares for later in the session

Online retailers also fall amid broader worries over the sector, Amazon -3.8%, Etsy -4.1%, EBay -0.6%, Shopify -6% after a PT cut at Citi; also watch Wayfair and Chewy. Here are some other notable pre-market movers:

- Shopify (SHOP US) shares fall as much as 6% in US premarket trading, as Citi cuts its price target on the e- commerce platform provider amid fresh economic headwinds.

- Cryptocurrency-exposed stocks are lower in US premarket trading as Bitcoin sank to a one-week low on Tuesday. The group is also pressured after a Bloomberg News report about the US Securities and Exchange Commission probing Coinbase over cryptocurrency listings.

- Alibaba (BABA US) shares jump 5.1% in US premarket trading after the Chinese e-commerce giant said it will seek a primary listing in Hong Kong, boosting other US-listed Chinese stocks higher with it.

- F5 (FFIV US) shares rise 7.8% in premarket trading on Tuesday, after the communications equipment company forecast better-than-expected adjusted earnings for the fourth- quarter.

- Koss Corp. (KOSS US) shares fall as much as 18% in US premarket trading, setting the headphones maker on track to trim part of the 43% surge it posted the previous session after reaching a deal with Apple in an AirPods patent infringement case.

- NXP Semiconductors (NXPI US) shares are down 1.2% in US premarket trading even as the company issued a strong forecast for the current quarter driven by demand for components used in automobiles. Analysts note that while supply is improving, demand continues to outstrip it.

- Aaron’s Co (AAN US) shares fell as much as 35% in postmarket trading on Monday as its revenue and earnings guidance cut shows the pressures facing the furniture and appliances retailer, with analysts anticipating that macro headwinds will continue to weigh

Meanwhile, investors are bracing for a flurry of earnings this week to gauge the ability of corporates to overcome supply constraints and soaring prices, just as the S&P 500 is on a course for its best month since October. A barrage of reports from GE, GM, 3M, RTX, MCD And UPS painted a mixed picture, with GE and 3M rising post-results while GM and UPS drop.

“There is still scope in the second half of this year, and maybe even early next year, for earnings disappointment,” said Paul Jackson, Invesco’s global head of asset allocation research, in a Bloomberg TV interview. “There’s still probably a delayed reaction for earnings, and then you have a layer on top of that, the margins squeeze that’s coming through higher raw material costs and in some sectors higher labor costs.”

Coca Cola Inc., McDonald’s Corp. and Mondelez International Inc. are among companies reporting earnings before the market open, while Texas Instruments Inc., Visa Inc., Microsoft Corp. and Alphabet Inc. will report after hours. These results “could really define an earnings season which, up until now, has been pretty resilient given the backdrop,” said Russ Mould, investment director at AJ Bell.

Tomorrow we also get the highlight of the week when the Fed is strongly expected to hike rates by 75 basis-points with many speculating that the Fed will have to inflict much more pain on the Biden economy to get inflation under control.

“For the time being, the Fed and other major central banks look much more concerned about the risk of inflation expectations becoming unanchored than high risk weighing on growth,” Valentine Ainouz, deputy head of developed markets research at Amundi, said in a Bloomberg TV interview. “Maybe in some months we will have a pivot toward growth, but this is not the mood right now, the mood now is fighting inflation.”

Markets are underestimating the risks of persisting inflation, which is likely to keep central banks hawkish for longer, according to Goldman Sachs strategists. Investors appear to be more optimistic on the central bank put, given that in past cycles the policy makers made a dovish pivot when growth slowed, strategists led by Cecilia Mariotti wrote in a note.

“The Fed’s main enemy is inflation, and it’s desperate to prevent expectations of sustained inflation from taking hold,” said Frédéric Leroux, a member of Carmignac’s strategic investment committee. “The recession that the Fed will probably provoke by its current monetary tightening is an avatar that it can withstand. In fact, it’s not beyond the realms of possibility that the central bank wants a recession, given the bearish effects it would have on prices.”

For Katerina Simonetti, an adviser at Morgan Stanley Private Wealth Management, the litany of risks exposes the vulnerability of the 6% rebound in global shares from June lows.

“This is most likely a bear market rally and there are significant risks still facing this market,” she said on Bloomberg Television. “We’re probably going to be seeing a lot of choppiness and potentially some further declines in the market before the year end.”

European shares edged higher, led by the FTSE 100 which climbed on rising oil and metal prices. Currencies are mostly steady and yields dipped ahead of the Fed meeting tomorrow. Euro Stoxx 50 is little changed. FTSE 100 adds 0.8%, FTSE MIB lags, dropping 0.4%. European energy and mining stocks outperform while retailers, autos and telecoms are the worst performing Stoxx 600 sectors. Here are some of the biggest European movers today:

- UBS shares drop as much as 7.2% after reporting 2Q results that missed expectations. Underlying pretax profit was about 10% below consensus with analysts pointing to a charge in Corporate Center.

- Eutelsat shares fall as much as 14%, extending yesterday’s losses, after the French satellite operator and OneWeb are set to combine in an all-share deal valuing its UK rival at $3.4 billion.

- Uniper drops for a fourth day, with shares down as much as 12.6% as a further supply reduction from Russia’s Gazprom helped send gas prices higher.

- Kesko shares fall as much as 7.6% after the Finnish consumer retail group published its latest earnings, which included declining margins in its Building & Technical retail segment in an otherwise solid report, Kepler Cheuvreux writes.

- Veolia shares fall as much as 4.4% as the stock was reinstated with an underweight rating at JPMorgan, with the broker bearish on the impact the French water and waste management group will face from Europe’s energy crisis.

- European retailers slump after Walmart cut its profit outlook, raising new questions about the resilience of consumer spending with inflation at a four-decade high. Zalando declines as much as -6.9%, Ahold -3.7%, Marks & Spencer -5.2%

- Unilever shares gain as much as 3.2% after the consumer-goods company reported 2Q sales that topped market expectations. Analysts found the sales beat reassuring, though noted the company had maintained its margin outlook for the year.

- Energy and mining shares are among best-performing groups in the Stoxx Europe 600 index on Tuesday as oil and metals rallied amid a decline in the dollar and signs of tightness in some commodity markets. Shell gains as much as 2.7%, BP +2.4%, Equinor +5.6%; Glencore +3%, Anglo American +3.3%

Earlier in the session, Asian stocks edged higher, rebounding from Monday’s decline, helped by a rally in Alibaba Group and other Chinese tech shares. The MSCI Asia Pacific Index advanced as much as 0.4%. Alibaba was the biggest contributor to the gauge’s gains after saying it will seek a primary listing, a move that would allow it to seek inclusion in the Stock Connect link with the Shanghai and Shenzhen exchanges. Sector-wise, consumer discretionary and financials were the top performers. Stocks in China gained despite a resurgence of Covid-19 infections that could threaten the operations of industry giants including BYD and Huawei Technologies, while Hong Kong’s equity benchmark was the best performer in the region. Investors are gearing up for a week of earnings releases from some of the biggest tech companies in the US, with the Fed’s meeting also in focus for further insights on the pace and quantum of rate increases. The MSCI Asiagauge jumped 3.6% last week.

“Despite the slew of data pointing to ongoing growth slowdown, markets seem to have been accustomed to such narrative lately, riding on expectations that growth risks have been priced to a large extent,” Jun Rong Yeap, a market strategist at IG Asia, wrote in a note. “That will clearly be put to the test to a greater extent this week with a series of big tech earnings, Fed’s policy guidance, along with key US inflation and consumer sentiment data ahead,” he wrote.

Key stock gauges in India declined ahead of the anticipated interest rate hike by the US Federal Reserve. The S&P BSE Sensex fell 0.9% to 55,268.49 in Mumbai, while the NSE Nifty 50 Index declined by a similar measure. The 30-member Sensex had 21 stocks trading lower. A gauge of information technology companies fell the most among the 19 sectoral indexes compiled by BSE Ltd., all of which declined. Software exporters Infosys and Tata Consultancy Services slipped as investors assessed global recession risks and increasing margin pressure on Indian technology companies. The Fed is expected to hike interest rates by 75 basis points on Wednesday to tame four-decade high inflation.

In FX, the dollar climbed, snapping three days of losses, as traders brace for a widely expected 75 basis points Fed rate rise on Wednesday, part of campaign to tackle inflation.The Japanese yen was little changed at 136.58 per dollar. Sterling fell, erasing gains after touching a three-week high against a broadly sluggish US dollar; still, it’s clinging on to $1.20, leading traders to watch if it can see out the month above key psychological levels.

In rates, treasuries are underpinned by rally in bunds amid concerns about European gas supply. Gains led by belly of the curve, eroding concession ahead of 5-year auction at 1pm New York time. US yields are richer by 2bp-4bp across the curve with the 10Y yield dropping to 2.75%, and a belly-led advance steepening 5s30s spread by 1.7bp; 2s5s30s fly drops 3.7bp on the day onto tightest levels since March ahead of 5- year sale. The final coupon auction cycle of May-July quarter continues with $46b 5-year note sale, following Monday’s solid 2-year auction. WI 5-year yield around 2.84% is ~43bp richer than June result, a 3.5bp tail. European peripheral spreads are mixed to Germany; Italy widens, Spain and Portugal tightens. Bunds advanced for a fifth day, the longest run since August as focus remains on gas supply concerns.

In commodities, crude futures rose for the 2nd day: WTI drifts 2.1% higher to trade near $98.74. Brent rises 1.8% near $107.07. Most base metals trade in the green; LME copper rises 2.8%. Spot gold rises roughly $4 to trade near $1,724/oz. Spot silver gains 1.1% near $19.

Todays’s economic data slate includes May FHFA house price index, S&P Case-Shiller house prices (9am), July Richmond Fed manufacturing index, consumer confidence, June new home sales (10am); this week also includes durable goods orders, 2Q GDP, personal income/spending (includes PCE deflator), MNI Chicago PMI and University of Michigan sentiment.

In terms of today we have the US July Conference Board consumer confidence index, Richmond Fed manufacturing index, June new home sales, and the May FHFA house price index. As discussed above EU energy ministers meet. Earnings is in full bloom with Microsoft, Alphabet, Visa, LVMH, Coca-Cola, McDonald’s, UPS, Texas Instruments, Raytheon Technologies, Unilever, Mondelez, 3M, General Electric, UBS, General Motors, ADM, Chipotle, and Deutsche Boerse all reporting. Elsewhere the IMF release their economic outlook update. Last but by no means least the FOMC start their crucial two-day meeting.

Market snapshot

- S&P 500 futures down 0.2% to 3,960.50

- STOXX Europe 600 up 0.1% to 426.79

- MXAP up 0.3% to 159.28

- MXAPJ up 0.5% to 522.24

- Nikkei down 0.2% to 27,655.21

- Topix little changed at 1,943.17

- Hang Seng Index up 1.7% to 20,905.88

- Shanghai Composite up 0.8% to 3,277.44

- Sensex down 0.7% to 55,385.81

- Australia S&P/ASX 200 up 0.3% to 6,807.27

- Kospi up 0.4% to 2,412.96

- German 10Y yield little changed at 0.98%

- Euro little changed at $1.0215

- Gold spot up 0.2% to $1,723.33

- U.S. Dollar Index little changed at 106.50

Top Overnight News from Bloomberg

- UBS Group AG’s investment bank disappointed in the second quarter as global deal activity collapsed and the trading business struggled to keep pace with Wall Street peers.

- European natural gas prices surged to the highest level in more than four months, as the region braces for a further reduction in Russian supply that could severely dent efforts to keep the lights on and homes warm this winter.

- Alibaba Group Holding Ltd. will seek a primary listing in Hong Kong, entrenching the financial hub’s status as an alternative to US markets and paving the way for investors in China to directly buy shares of the country’s most prominent e-commerce company for the first time.

- Coinbase Global Inc. is facing a US probe into whether it improperly let Americans trade digital assets that should have been registered as securities, according to three people familiar with the matter.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took their cue from Wall Street and eventually traded mostly higher, albeit some with mild gains, after seeing mixed trade in the early hours until the Chinese open. ASX 200 was supported by its energy and mining sectors as underlying oil and metals prices rose, Nikkei 225 moved back toward the 27.5k mark to the downside amid currency dynamics whilst the KOSPI was kept afloat after Q2 GDP topped expectations. Hang Seng overlooked reports that Hong Kong may have to downgrade its annual growth forecast and surged amid a boost from Alibaba rising almost 4% as it plans for a primary listing in Hong Kong, which would make it eligible for the Stock Connect programme and allow mainland Chinese investors to trade Co. shares, in turn helping increase liquidity. Shanghai Comp posted modest gains, but the upside was capped as Shanghai added 10 high and medium-risk areas subject to lockdown.

Top Asian News

- Shanghai adds 10 high and medium-risk areas subject to lockdown, according to Bloomberg.

- Alibaba (9988 HK/BABA) is pursuing a primary listing on the Hong Kong exchange, expected to occur before the end of 2022; Co. will become a dual primary listed Co. on HKEX and NYSE.

- Hong Kong may have to downgrade its annual growth forecast in August for the second time in three months, according to SCMP citing the finance chief.

- PBoC set USD/CNY mid-point at 6.7483 vs exp. 6.7490 (prev. 6. 7543).

- PBoC injected CNY 5bln via 7-day reverse repos with the maintained rate of 2.10% for a net drain of CNY 2bln

European bourses are under modest pressure, Euro Stoxx 50 -0.4%, in what has been a limited session of newsflow ahead of the EU energy update and US earnings; though, strength in commodities is lifting the FTSE 100 +0.5%. However, further pressure has been seen in wake of most recent Kremlin related commentary, with the Nord Stream 1 turbine yet to be installed. Stateside, US futures are dented to the tune of crica. 5/10s of a percent; but, fairly rangebound (ex-above Kremlin related moves) overall pre-earnings and Wednesday’s FOMC.

Top European News

- Porsche IPO, Software Fix: What Awaits VW’s New CEO

- European Oil and Mining Stocks Outperform Amid Commodity Gains

- Hedging Bond Trades Is Getting Harder in UK’s Volatile Markets

- Rolls-Royce Names Ex-BP Executive as CEO to Succeed East

- Beijing Denounces Truss Vow to Crack Down on China Firms in UK

- UBS CEO Hamers Signals Worst Over for Asia Deleveraging

Central Banks

- RBNZ Governor Orr says in addition to remit review, RBNZ will also review recent performance in conducting monetary policy; will assess inflation and employment outcomes relative to targets, via Reuters.

- CNB’s Frait says policy is already quite restrictive, won’t rule out a hike now or in the near time. Temporary FX interventions are normal in situations of shock to balance of payments, via Reuters.

FX

- Aussie fades after probing Fib resistance vs Greenback and Loonie following oil powered rise to best levels since mid-June, AUD/USD back under 0.6950 from 0.6983, USD/CAD above 1.2880 from sub-1.2820.

- Dollar regains poise otherwise in choppy, cautious trade pre-FOMC, DXY rebounds firmly from 106.190 surpassing Monday high of 106.890 to 107.10+.

- Yen and Franc find some traction from pronounced bounce in bonds and reversion to bull-flattening, USD/CHF and USD/JPY hold below/above 0.9650 and 136.50 respectively.

- Euro undermined by ongoing Russian gas supply jitters ahead of Extraordinary Energy Summit, EUR/USD retreats from 1.0250 to circa 1.0140.

- Pound pulls up after narrowly missing 1.2100 vs Buck, Cable now below 1.2000, albeit still relatively comfortably above a series of recent descending lows.

Fixed Income

- Bonds back in bull-flattening mode as Bunds front run latest leg higher.

- 10 year German benchmark reaches 155.90 and peaks not seen since late May, while yield breaches 1% with more conviction.

- Gilts and T-notes lag within 117-6935 and 120-04/119-24 respective ranges ahead of the Fed tomorrow and BoE next week.

- BTPs off lest levels and lag periphery peers amidst short term and linker supply.

Commodities

- Dutch TTF continues to lift with the August contract in proximity to EUR 200 as Nord Stream 1 is set to be curtailed tomorrow; however, the EU has agreed on a deal to reduce gas use.

- Crude benchmarks are bid and drawing impetus from the referenced factors and EU divisions, though the magnitude of the move is more modest in nature vs TTF.

- EU nations agree to reduce gas use for next winter.; only Hungary voted against approval of mandatory gas rationing if Russia shuts off the taps, France24 reports. Reminder, press conferences are expected at 12:30BST/07:30ET and 15:00BST/10:00ET.

- EU energy chief Simson says Europe has to be prepared for supply cuts from Russia at any moment, expects to have a deal today in curbing gas demand.

- Libyan oil minister says oil production is 1.1mln BPD.

- China is to lower retail prices of gasoline and diesel by CNY 300 and CNY 290/tonne respectively as of July 27th.

- Spot gold is little changed overall and moving at the whim of the USD while base metals remain bid in a continuation of APAC trade.

Crypto

- Coinbase (COIN) faces SEC probe over crypto listings, according to Bloomberg sources.

- US House lawmakers are reportedly delaying consideration of a bipartisan bill to regulate stablecoins, according to WSJ citing sources, pushing back consideration of the measure until after Congress’ August break.

US Event Calendar

- 09:00: May FHFA House Price Index MoM, est. 1.5%, prior 1.6%

- 09:00: May S&P/CS 20 City MoM SA, est. 1.50%, prior 1.77%

- 09:00: May S&P CS Composite-20 YoY, est. 20.60%, prior 21.23%

- 10:00: July Conf. Board Consumer Confidence, est. 97.0, prior 98.7

- Expectations, prior 66.4

- Present Situation, prior 147.1

- 10:00: July Richmond Fed Index, est. -14, prior -11

- 10:00: June New Home Sales MoM, est. -5.4%, prior 10.7%

- June New Home Sales, est. 658,000, prior 696,000

DB’s Jim Reid concludes the overnight wrap

10 years ago today Draghi uttered the seminal lines “whatever it takes” when referring to keeping Europe together when ECB President. It clearly worked but a decade later, Europe is again facing testing times, still partly because of Italy but also because of inflation and an energy crisis that has flared up again over the last 24 hours.

Indeed in yesterday’s EMR we discussed how this week was all about the US (FOMC and likely technical recession confirmation) but that we needed to watch the gas flows as Putin had suggested late last week that if the turbine didn’t make it back to Russia by early this week gas flows could be cut back from 40% capacity to 20% due to works being required on another turbine. The news flow yesterday was originally more positive as documentation between Siemens and Gazprom seemed to indicate that the repaired turbine issue was getting closer to being finalised. However the day turned late in the European session as Gazprom announced that another turbine will go out of service at 7am tomorrow for maintenance and gas would indeed be cut back to 20%. We can’t say we weren’t warned I suppose. It’s a bit confusing as to whether this will be a short restriction of supply while the repaired turbine makes its way back online or whether the paperwork will never quite be resolved, and we live with only 20% supplies for a considerable time. Siemens and the German government have said that there is no reason for transportation of the repaired turbine not to start back on its final leg to Russia.

Peter Sidorov has published a review of the latest news here and what it means for the economy over winter in an overnight blog. Peter says that from reading the Russian version of the latest statement from Gazprom, they are looking for clearer guarantees on future sanctions exemptions for maintenance of NS1 and related issues. This will likely be hard to achieve and the Russians will know this. So it appears like Russian politics will be in control here for now.

As we mentioned last week, at 40% capacity Germany could make it through the winter even if some light rationing was needed. At 20% you would likely need some notable rationing unless they cut gas exports which would be a very delicate thing to do politically. Gas futures rallied around 10% on the news, closing a touch under that. EU energy minister meet today to discuss the ongoing crisis and potentially revise the rationing plans laid out by the EC last week. The potentially forced 15% reduction that all member states would have to adhere to was very unpopular amongst several members. Expect lots of carve-outs and compromises to appear if a plan that can progress is agreed upon.

The biggest market impact to yesterday’s gas move (outside of gas itself of course) was in bonds, with bunds falling -6bps into the close after an earlier sell-off in bonds. 10yr Bunds closed c.-1bps lower. There wasn’t any major move in spreads though as Italy tightened a basis point to bunds. European equities dipped on the news but mostly stayed in positive territory with the exception of the DAX (-0.33%). The Stoxx 600 closed +0.13%.

The US is certainly taking an interest in Europe’s problems at the moment (Gas and Italy) but it generally then moves on and marches to its own beat. 10yr Treasuries still climbed c.+5bps, even if they were 4bps off the days highs. This morning in Asia, yields on are around -1bps lower, trading at 2.786%, as we go to press. US equities generally held onto gains with the S&P 500 (+0.13%) but with the NASDAQ (-0.43%) dipping ahead of a huge week of tech earnings. We have Microsoft and Alphabet after the bell today followed by Meta tomorrow and Apple and Amazon on Thursday. So that’s over $7.5 trillion of market cap here alone at stake over the next couple of days although with these 5 stocks being down between around -13% (Apple) YTD to around -50% (Meta), with the other three down around -20 to -25%, this figure would have been closer to $10 trillion at the start of the year. Elsewhere in earnings land, we have GM, NXP Semiconductors, Raytheon Technologies, Coca-Cola, McDonald’s, Unilever and Mondelez reporting today amongst others. So plenty to keep an eye on today and for the rest of the week on the reporting front.

Back to US equities and Energy was the main winner (+3.71%) as Oil rose c.+2% yesterday and is up another +1.25% this morning ahead of some big oil majors reporting this week. Consumer Discretionary (-0.85%) was the weakest, likely on the bubbling recession fears. After the bell Walmart cut their outlook for Q2 and FY 23 and with it their equity fell -9.94% in after hours. As a result US futures are down with contracts on the S&P 500 (-0.28%) and NASDAQ 100 (-0.40%) edging lower this morning.

Asian equity markets have been fluctuating this morning and are still mostly higher with the Hang Seng (+1.60%) leading gains after Alibaba rose as much as +4.80% as it announced that it will be applying for a primary listing on the Hong Kong Stock Exchange. If completed, Alibaba will become a dual-primary listed company in Hong Kong and New York. The move is expected to happen by year-end. Over in mainland China, the Shanghai Composite (+0.81%) and the CSI (+0.96%) are climbing, reversing their previous session declines whilst the Nikkei (-0.06%) is fractionally lower this morning. Elsewhere, the Kospi (+0.12%) is edging up as South Korea’s Q2 growth rose +0.7% q/q (v/s +0.4% expected), faster than the +0.6% growth in the first quarter.

Data yesterday wasn’t top tier but both Chicago and Dallas Fed activity indices were slightly weaker than expected. The German IFO was slightly weaker too (88.6 vs 90.1 expected) but it was hard to upstage the poor PMIs from last Friday which set the tone for a major rally in bunds at the back end of last week. Its remarkable that after an initial spike to 0.765% for 2 year Bunds after the ECB, they dipped to 0.35% a day later after first the TPI wobbles and then the weak PMIs, and to around 0.4% at the close last night.

In terms of today we have the US July Conference Board consumer confidence index, Richmond Fed manufacturing index, June new home sales, and the May FHFA house price index. As discussed above EU energy ministers meet. Earnings is in full bloom with Microsoft, Alphabet, Visa, LVMH, Coca-Cola, McDonald’s, UPS, Texas Instruments, Raytheon Technologies, Unilever, Mondelez, 3M, General Electric, UBS, General Motors, ADM, Chipotle, and Deutsche Boerse all reporting. Elsewhere the IMF release their economic outlook update. Last but by no means least the FOMC start their crucial two-day meeting.