OPINION: This article contains commentary which may reflect the author’s opinion

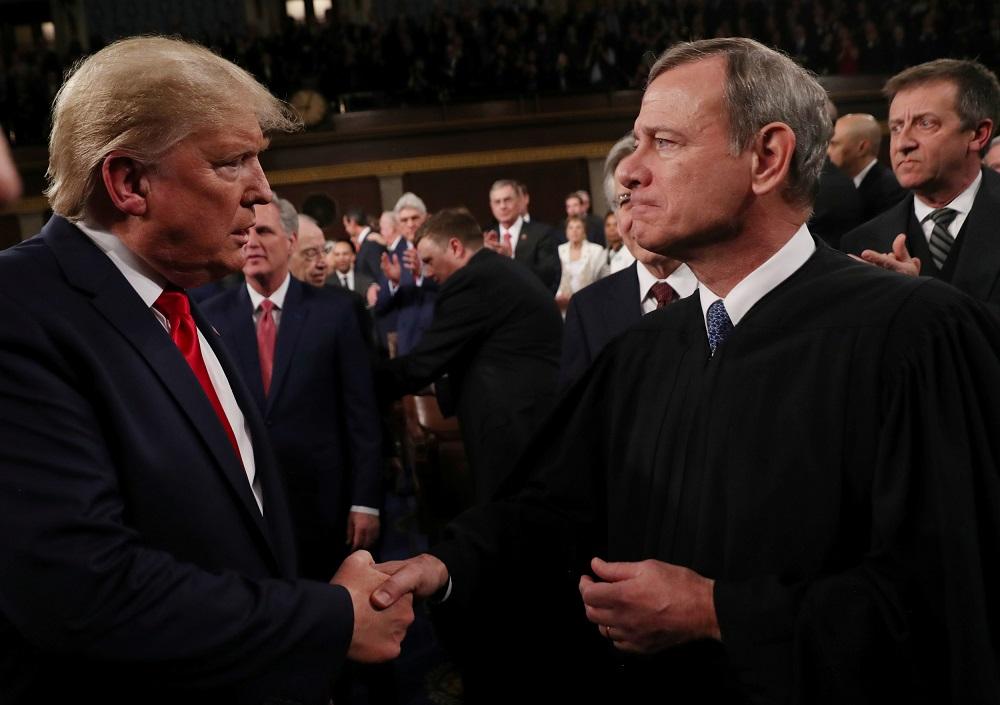

Democrats always want to raise taxes, we know this quite well. Now it looks as if Trump’s Supreme Court picks are paying off.

In 2018, New York, New Jersey, Maryland, and Connecticut sued the federal government over the tax deduction cap, which was implemented by then-President Trump as part of the tax reform law.

When itemizing federal deductions, taxpayers can deduct no more than $10,000 in their state and local taxes per year.

The Second Circuit Court of Appeals rejected the state’s claim that the deduction cap violated their sovereignty in October of last year.

In March, the states filed in court that, “Congress’s taxing authority (as set forth in Article I, Section 8 and the Sixteenth Amendment) is cabined by the structural requirements of federalism, which prevent the federal government from directly interfering with the States’ ability to generate revenue to sustain their operations. The long history of federal income taxation demonstrates that Congress and the States equally understood that a deduction for all or nearly all state and local property and income taxes was constitutionally required to preserve state sovereign taxing authority.”

The Supreme Court ruled against them though, so New York and the three other states will not get a second chance to overturn the $10,000 limit on state and local taxes, known as SALT.

No reasoning from any of the justices accompanied the court’s denial of certiorari.

With Monday’s order, it was assured that the deduction cap would remain in place barring any Congressional action.

By the end of this year, Democrats from high-tax blue states hope to lift the income tax cap by adopting a version of President Biden’s Build Back Better bill.

A group of moderates has proposed raising the cap from $10,000 to $80,000 and has threatened to drop their support for a scaled-down version of the social spending bill unless it is included.

“No SALT, no deal! In November, the House passed Build Back Better, legislation that addressed the SALT cap. This legislation has been held up in the Senate ever since,” tweeted Suozzi (D-NY) last November. “A SALT fix must be part of the Senate’s version of Build Back Better. New Yorkers need relief now.”

Nevertheless, socialist Democrats oppose plans to raise the cap, with Rep. Alexandria Ocasio-Cortez (D-NY) calling it a “gift to the billionaires.”

Gottheimer hit back in February, accusing his socialist comrades of “hypocrisy” in an interview with reporters.

He argued progressive criticisms of addressing the cap are unfounded, noting the issue is one that affects “cops, firefighters, and teachers” in high-tax states. As a result of the current policy, the New Jersey Democrat noted that people in states like New Jersey and New York are moving to states with lower tax rates, which may be harmful to their communities.

“If they actually care about folks, they should want to make sure it’s all restored,” he argued, “because the states that tend to pay more and have higher tax burdens, but the states that are higher-cost states and that do more for folks and invest more in communities and families, you would think that they would be more for this.”

Congress has been unable to move forward with the Build Back Better plan since December when West Virginia Democratic Sen. Joe Manchin said he would oppose the current version.

Fox News reported that:

The current Democrat-controlled House passed a bill in 2021 that would temporarily raise the cap to $80,000 until 2031, when it would go back to $10,000. The Senate has yet to take action on the bill, although a separate plan in the Senate led by Sen. Bernie Sanders, I-Vt., would cap the tax break by income, making it unlimited for individuals earning about $400,000 and phasing it down above that amount. Republicans have criticized the bill, saying it would disproportionately benefit ultra-wealthy Americans in blue states.

The current SALT cap is set to expire after 2025.

New York is attempting to get around the deduction cap, though.

As Bloomberg Tax reported last week:

Thousands of additional New York businesses may now be able to seize on a lucrative tax break after policy makers agreed to make a technical fix as part of a $220 billion budget deal signed into law by Gov. Kathy Hochul.

Tucked inside the largest-ever state spending plan, which promises a little less pain at the pump and help for working parents, is also an adjustment to the state and local tax law that will now allow more New York residents to receive the full benefit of a SALT cap workaround passed last year.

“The limitation was really negatively impacting lots of New York residents who own S corporations in New York,” said Timothy Noonan, a tax attorney at Hodgson Russ in New York City.

Single shareholder S corporations, along with S corps that had a mix of resident and nonresident shareholders, received limited tax benefits from last year’s “pass-through entity tax,” which gave partnerships, limited liability companies, and S corporations a way to ease the pain of a $10,000 federal cap on individuals’ deductions for state and local taxes paid.

Tax changes would apply starting in tax year 2022. However, the deadline for firms to elect for the pass-through entity tax for this year closed on March 15.

New York followed other states, including neighboring New Jersey and Connecticut, that provided the adjustment following guidance from the Internal Revenue Service last November that allows some kinds of workarounds for the cap imposed in the 2017 tax law.

Source: The Republic Brief